The landscape for local businesses is constantly evolving, marked by economic shifts, increased competition, and evolving customer expectations.

In this dynamic environment, robust financial management isn’t just a good practice; it’s the bedrock of survival and a powerful engine for growth.

For many local entrepreneurs, understanding and optimizing their financials can feel daunting.

However, by implementing smart financial strategies, business owners can not only navigate current challenges but also unlock significant profit gains and build a more resilient enterprise.

This article provides a comprehensive guide to fortifying your business‘s financial health and boosting profitability, starting today.

Navigating Today’s Economic Landscape for Local Success

The backbone of any thriving community is its local businesses.

These enterprises, which constitute 99.

9% of all U.S.

businesses according to BusinessDasher, are uniquely positioned to serve their neighborhoods.

However, they face a distinct set of pressures.

Inflationary trends and supply chain disruptions have significantly increased operational costs, while the digital revolution demands constant adaptation.

The ability to not just survive but thrive in this climate hinges on a deep understanding of one’s financials and the proactive application of intelligent financial planning.

The Unique Pressures on Local Businesses Today

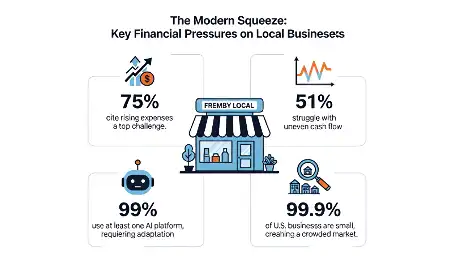

A snapshot of the primary financial challenges that define the modern landscape for local businesses.

Local businesses contend with multifaceted challenges.

Rising expenses for goods, services, and wages remain a primary concern, with 75% of small firms citing them as a top financial challenge.

Beyond these direct costs, competition from larger corporations and online retailers often necessitates innovative marketing and customer engagement strategies.

Furthermore, managing cash flow can be precarious; 51% of small businesses struggle with uneven cash flow, making consistent profitability an ongoing pursuit.

Adapting to new technologies, such as AI, is also becoming a necessity, with 99% of small businesses using at least one AI platform.

These pressures demand more than just reactive measures; they require a strategic, forward-thinking approach to financial management.

Why Proactive Financial Strategies are Your Secret Weapon

In a landscape fraught with uncertainty, a proactive financial strategy acts as a business owner’s most potent asset.

It transforms financial management from a reactive chore into a strategic advantage.

Proactive financial planning allows you to anticipate challenges, capitalize on opportunities, and make informed decisions that drive profitability and sustainable growth.

Instead of merely reacting to market changes, you can shape your business’s trajectory by understanding your numbers intimately, optimizing your spending, and strategically generating revenue.

This approach fosters trust and confidence, not only within your organization but also with your stakeholders, including lenders and customers.

Embracing these strategies means moving beyond day-to-day operations to build a robust, profitable, and enduring local business.

Section 1: Mastering Your Numbers for Immediate Profit Gains

The foundation of any successful business strategy is a clear, unvarnished understanding of its financial performance.

For local businesses, this means moving beyond basic bookkeeping to actively dissecting the financials to uncover actionable insights that can immediately boost margins and profitability.

Beyond Basic Budgeting: Deep Dive into Profit Margin Analysis

A budget is essential, but true profitability lies in understanding your margins.

This involves analyzing both gross and net profit margins to identify which products or services are most lucrative.

Gross profit margin (Revenue – Cost of Goods Sold / Revenue) reveals the profitability of your core offerings before operating expenses.

A low gross margin might indicate issues with pricing or sourcing costs.

Net profit margin (Net Income / Revenue) shows the overall profitability after all expenses are accounted for.

Analyzing these margins for individual products or service lines is crucial.

For example, a product might have a high sales volume but a razor-thin margin, while another sells less but contributes significantly to the bottom line.

Identifying these discrepancies allows business owners to make strategic decisions about inventory, pricing, and resource allocation, directly impacting profitability.

Decoding Your Financial Statements: Actionable Insights for Growth

Your Profit and Loss (P&L) statement, Balance Sheet, and Cash Flow Statement are not just historical records; they are powerful diagnostic tools.

The P&L highlights revenue and expenses over a period, pinpointing profitability trends.

A rising P&L indicates growth, while stagnant or declining figures signal a need for intervention.

The Balance Sheet provides a snapshot of your assets, liabilities, and equity, revealing your business‘s financial health and stability.

Analyzing your current assets versus liabilities can inform your short-term financial planning.

The Cash Flow Statement is paramount for understanding liquidity – how cash moves in and out of your business.

For local businesses, this statement is critical for managing operational expenses and identifying potential shortfalls before they impact crucial cash flow.

Regularly reviewing these statements, ideally with an accountant or financial advisor, provides business owners with the data needed for informed decision-making and strategic growth.

Data-Driven Customer Insights for Revenue Optimization

Understanding your customer is key to optimizing revenue.

By analyzing sales data, business owners can identify their most profitable customer segments.

Metrics like Customer Lifetime Value (CLV) – the total revenue a customer is expected to generate over their relationship with your business – are invaluable.

Investing in retaining existing customers is often more cost-effective than acquiring new ones.

Analyzing purchase history can reveal patterns, allowing for targeted promotions, personalized offers, and improved marketing efforts.

For instance, identifying customers who frequently purchase high-margin items allows for focused campaigns to encourage further engagement.

Leveraging software to track customer interactions and purchase behaviors can provide deep insights, enabling small business owners to tailor their offerings, enhance customer trust, and ultimately drive increased revenue through better customer relationship management.

Section 2: Strategic Cost Optimization: Spending Smarter, Not Just Less

Effective cost management isn’t about arbitrary cuts; it’s about intelligent allocation of resources to maximize efficiency and free up capital for growth.

This strategic approach to expenses is vital for enhancing margins and overall business health.

Rethinking Overhead: The “Lean & Local” Approach

The concept of “lean” operations can be powerfully applied to local businesses.

This means scrutinizing all overhead costs – from rent and utilities to insurance and administrative expenses – not to eliminate them, but to optimize their contribution to the business.

For example, renegotiating leases, exploring energy-efficient upgrades, or adopting flexible work arrangements can reduce fixed costs.

A “lean & local” approach also involves streamlining internal processes to minimize waste.

This might include optimizing inventory management to reduce storage costs and spoilage, or implementing better scheduling to manage staffing expenses efficiently.

The goal is to ensure every dollar spent directly supports the business‘s revenue-generating activities and long-term growth, rather than becoming a drain on profitability.

Tech-Enabled Efficiency: Smart Software & Subscriptions that Pay for Themselves

In today’s digital age, software and subscriptions are not just overhead; they are often crucial investments in efficiency and productivity.

While the cost of numerous software solutions can add up, their strategic implementation can yield significant returns.

Consider customer relationship management (CRM) software to enhance marketing and sales efforts, or accounting software to streamline financials and reduce errors.

The rapid adoption of AI is transforming small businesses, with 99% using at least one AI platform, and 58% using generative AI.

These tools can automate repetitive tasks, improve data analysis, and enhance customer service.

Business owners should conduct a thorough ROI analysis for each software or subscription, focusing on how it directly contributes to increased revenue, reduced expenses, or improved efficiency.

Smart Vendor Management & Supply Chain Optimization

Effective vendor management is a cornerstone of cost control and operational resilience for local businesses.

Building strong relationships with suppliers can lead to better pricing, favorable payment terms, and improved reliability.

Regularly review your vendor contracts and explore opportunities for negotiation, especially for recurring costs.

Consider the total cost of ownership, not just the upfront price, factoring in delivery times, quality, and payment flexibility.

Optimizing your supply chain might involve consolidating vendors to achieve bulk discounts or exploring alternative local suppliers to reduce shipping costs and lead times.

This proactive approach to managing suppliers ensures a steady flow of goods and services while minimizing unnecessary expenditure, directly impacting your margins and cash flow.

Section 3: Proactive Revenue Generation & Optimized Cash Flow NOW

While managing costs is critical, sustainable profitability ultimately depends on effective revenue generation and robust cash flow management.

Local businesses have unique opportunities to implement strategies that drive income and accelerate the movement of cash, securing their immediate and future growth.

Strategic Pricing & Value Enhancement

Pricing is a delicate art for any business.

Moving beyond cost-plus pricing, consider value-based pricing, where your pricing reflects the perceived value your product or service delivers to the customer.

This requires understanding your customer‘s needs and willingness to pay.

Bundling complementary products or services can increase average transaction value and customer satisfaction.

For businesses offering services, dynamic pricing models or tiered service packages can cater to different customer segments and maximize revenue potential.

Regularly reviewing and adjusting your pricing strategy based on market conditions, competitor analysis, and customer feedback is essential for maintaining competitive margins and ensuring consistent revenue streams.

Building Customer Loyalty & Driving Repeat Business

Acquiring new customers is considerably more expensive than retaining existing ones.

Focusing on customer loyalty is a powerful growth strategy that directly impacts profitability.

Implementing loyalty programs, offering exclusive discounts, or providing exceptional customer service can foster repeat business.

Personalized communication, remembering customer preferences, and proactively seeking feedback build trust and strengthen relationships.

For local businesses, community engagement and personalized interactions are significant advantages.

By understanding what keeps your customer base engaged and satisfied, you can create a predictable revenue stream, reduce reliance on costly marketing to attract new patrons, and enhance overall business growth and stability.

Exploring New Revenue Streams & Local Collaborations

Diversifying revenue streams can significantly strengthen a business‘s financial resilience and unlock new avenues for growth.

Identify complementary products or services that align with your core offerings.

This might involve expanding your product line, offering training or consulting services, or creating digital products.

Local businesses can also thrive through collaboration.

Partnering with other local businesses for cross-promotions, joint events, or shared marketing initiatives can expand your reach and attract new customers without significant upfront investment.

Such collaborations build trust within the local ecosystem and can lead to innovative revenue-generating opportunities that benefit all parties involved.

Optimizing Cash Flow Management: Accelerating Receivables and Managing Payables

Effective cash flow management is paramount, especially since 51% of small businesses struggle with uneven cash flow.

Accelerating receivables means getting paid faster.

This can be achieved by invoicing promptly, offering early payment discounts, and implementing clear, consistent follow-up procedures for overdue accounts.

Utilizing software for automated invoicing and payment reminders can streamline this process.

Equally important is managing your payables strategically.

Negotiate favorable payment terms with suppliers to align them with your incoming cash flow.

Avoid late payment fees, which erode profitability.

Maintaining a healthy cash flow provides the liquidity needed to cover expenses, invest in opportunities, and navigate unexpected financial challenges, ensuring smoother business operations and supporting growth.

Section 4: Smart Tax Strategies for Maximizing Your Bottom Line

Effective tax management is not just about compliance; it’s a strategic lever for enhancing profitability and retaining more of the income your business earns.

By engaging in proactive tax planning, business owners can minimize their tax burden and boost their bottom line.

Beyond Standard Deductions: Uncovering Hidden Tax Advantages

Many business owners are aware of basic deductions, but a deeper dive can reveal significant tax advantages.

This includes exploring industry-specific credits, such as those for research and development (R&D) or energy-efficient upgrades.

For instance, investments in new technology or processes could qualify for R&D tax credits.

The structure of your business also impacts your tax obligations; consulting with a tax professional can help determine the most advantageous entity structure (e.g., sole proprietorship, LLC, S-corp) for your specific situation.

Furthermore, strategic use of depreciation on assets and understanding available tax deductions for expenses like home office use, marketing, and employee benefits can significantly reduce your overall tax liability, directly increasing your net margins.

Proactive Tax Planning: A Year-Round Approach to Minimize Burden

Tax planning should not be an end-of-year activity but an ongoing, year-round process.

This proactive approach allows business owners to make informed decisions throughout the year that can impact their final tax bill.

Strategies include estimating tax liabilities and making quarterly payments to avoid penalties, and engaging in tax-loss harvesting if you have investments that have declined in value.

Understanding and timing major capital expenditures or asset sales can also have significant tax implications.

Building trust with your accountant or tax advisor and involving them in your strategic financial planning ensures you are always aligned with current tax laws and maximizing opportunities to reduce your tax expenses legally and ethically, thereby bolstering profitability and ensuring financial stability for your small business.

Section 5: Building Financial Resilience and Long-Term Sustainability

Beyond immediate profit gains and cost optimization, building a resilient and sustainable local business requires a long-term financial vision.

This involves establishing robust financial safeguards, fostering strong relationships, and ensuring the financial well-being of both the business and its owner.

The Foundation: Building a Robust Emergency Fund

An emergency fund is not a luxury; it’s a necessity for navigating unforeseen challenges.

Unexpected events, such as economic downturns, equipment failures, or sudden drops in customer demand, can severely impact cash flow.

A well-funded emergency fund provides a crucial safety net, allowing your business to weather these storms without resorting to high-interest debt or drastic cuts that could harm long-term growth.

Aim to set aside enough to cover at least 3-6 months of operating expenses.

This fund instills trust in your ability to manage the business through adversity and provides peace of mind for business owners, ensuring that a single setback doesn’t derail the entire enterprise.

Cultivating Strong Banking Relationships & Accessing Funding

Strong relationships with financial institutions are vital for local businesses.

Beyond routine transactions, a good banking partner can provide essential support, including lines of credit, loans, and financial advice.

As applications to large banks fell from 44% to 39% between 2023 and 2024, exploring various lending avenues, including community banks and credit unions, becomes important.

Demonstrating sound financial planning, consistent cash flow, and a clear budget strengthens your position when seeking financing.

Access to appropriate funding, whether for expansion, inventory, or bridging cash flow gaps, is critical for sustained growth and operational continuity.

Empowering Your Team & Enhancing Financial Literacy

Your team is a crucial asset in managing your business‘s financials.

Fostering a culture of financial awareness can lead to more responsible spending and innovative cost-saving ideas.

Providing basic financial training to your team can empower them to understand how their actions impact the business‘s bottom line, from reducing waste to improving customer service that drives revenue.

This shared understanding builds trust and encourages collective ownership of financial goals.

When your team is financially literate, they can better contribute to operational efficiency, support your financial planning efforts, and help maintain healthy margins and cash flow.

Personal Financial Health for the Business Owner

The financial health of the business owner is inextricably linked to the health of the business itself.

Personal financial instability can lead to stress, poor decision-making, and the blurring of personal and business finances.

It’s essential for business owners to maintain a clear separation between personal and business expenses, establish a reasonable owner’s draw or salary, and maintain their own personal budget and savings.

This not only ensures personal well-being but also provides the clarity needed for sound business strategy and financial planning.

A secure personal financial foundation allows business owners to approach their ventures with a clear mind, free from undue personal financial pressures, fostering better trust and a more stable overall enterprise.

Your Path to Boosted Profitability Starts Now

Navigating the complexities of today’s economic climate demands more than just hard work; it requires smart financial strategies.

By mastering your financials, optimizing costs, proactively generating revenue, managing taxes strategically, and building long-term resilience, local businesses can significantly boost their profitability and secure their future.

The journey toward enhanced financial health is an ongoing process, but one that yields immense rewards.

Recap of Key Strategies

We’ve explored how deep dives into profit margin analysis and financial statements can uncover actionable insights for growth.

Strategic cost optimization, from rethinking overhead to leveraging software and smart vendor management, ensures you’re spending smarter.

Proactive revenue generation, including strategic pricing and building customer loyalty, coupled with meticulous cash flow management, provides the lifeblood for your business.

Furthermore, smart tax planning acts as a powerful tool to maximize your retained earnings, while building an emergency fund and strong banking relationships fortifies your business against unforeseen challenges.

Empowering your team and prioritizing your personal financial health are critical components of overall business sustainability and trust.

Take Action Today

The most crucial element in any financial strategy is implementation.

Begin by reviewing your latest financial statements to understand your current position.

Identify one area from this article – perhaps analyzing your profit margins for a specific product line, or reviewing your vendor contracts for potential savings.

Implement a small, actionable change related to cash flow management or a new marketing initiative.

Even minor adjustments, consistently applied, can lead to significant improvements over time.

Don’t wait for the perfect moment; the time to start fortifying your business finances is now.

The Future of Your Local Business is in Your Hands

Your local business is more than just an enterprise; it’s a vital part of your community.

By embracing smart financial strategies, you are not only ensuring its profitability and sustainability but also strengthening its ability to serve and grow.

With diligent effort, strategic financial planning, and a commitment to continuous improvement, you can transform your business‘s financial outlook, drive sustainable growth, and build a legacy of success.

The power to boost your profitability and secure your future lies within your grasp.